The principle of not putting all your eggs in one basket applies to the world of investing as well. Various factors, such as economic cycles, geopolitical shifts, regulatory changes, or unforeseen events, can impact financial markets. Therefore, diversifying a portfolio across different investments, sectors, investment styles, geographic regions, and asset classes can help protect it from uncertainties and market volatility. Nobel Laureate Harry Markowitz introduced the Modern Portfolio Theory in the 1950s, demonstrating how a well-diversified portfolio can reduce risk without sacrificing potential returns.

To build a well-diversified portfolio, investors should start by understanding their investment goals, risk tolerance, time horizon, and liquidity needs. This process, known as setting investment objectives, forms the foundation of portfolio construction. It helps identify an appropriate asset allocation that aligns with the investor’s profile.

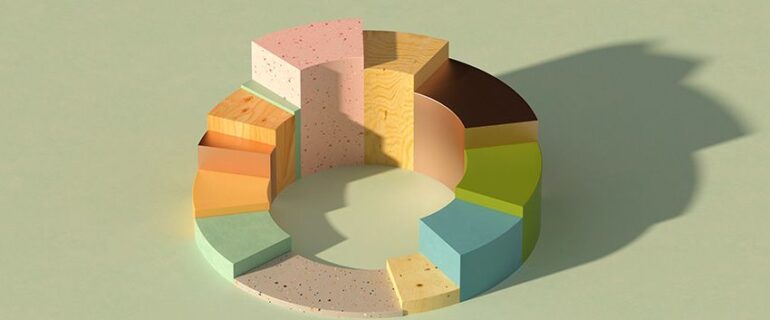

Once the investor profile is established, the next step is determining the optimal mix of asset classes. Traditional asset classes include equities, bonds, and cash. However, non-traditional investments such as private equity (PE), venture capital (VC), venture debt, structured credit, real estate, commodities, and others should also be considered based on investor suitability. Equities offer growth potential but come with higher risk due to market fluctuations. Bonds, on the other hand, offer lower risk and stable returns. Cash or equivalent instruments should hold funds needed for immediate liquidity.

Non-traditional assets like PE and VC, known as private markets, have lower correlation with traditional assets and higher return potential but also involve increased risk and illiquidity. Venture debt and structured credit are newer asset classes in India that can enhance returns but come with higher risk. Real estate offers both income generation and capital appreciation opportunities and can be accessed directly, through funds, or via real estate investment trusts (REITs).

Gold is a favored asset class in India due to its negative correlation with equities, serving as a hedge against volatility among commodities.

Diversification within an asset class is equally important. For example, within equities, investors should diversify across large-cap, mid-cap, and small-cap companies, as well as different sectors and industries. Additionally, diversification should consider investment styles, such as growth-oriented versus value-oriented approaches, and active versus passive investments. Similarly, within fixed-income and alternative asset classes, there are opportunities for diversification.

Many investors have a home country bias, investing primarily in their domestic markets. However, this exposes the portfolio to country-specific events and risks. International investments in equities or bonds can provide exposure to diverse economies and currencies, reducing such risks. Different economies often have diverging economic cycles, creating opportunities for portfolio alpha generation. Certain sectors may thrive in specific countries, such as technology in the US or semiconductors in Taiwan.

At the security level, diversification is essential. When investing in individual stocks or bonds, diversifying across a few securities is crucial. Mutual funds and ETFs inherently offer diversification, but holding multiple ETFs tracking the same index or numerous mutual funds of the same style may not significantly benefit diversification.

Once a well-diversified portfolio is constructed, it requires periodic adjustments in response to market conditions and regular rebalancing. Over time, the portfolio’s asset allocation may deviate from the initial plan due to variations in asset class performance. Regular rebalancing realigns the portfolio with its intended mix, selling overperforming assets that may be relatively expensive and acquiring underperforming assets that may be undervalued.

It’s essential to acknowledge that all investments carry some degree of risk. Diversifying a portfolio does not eliminate risk but spreads it across different assets and investments.

![]()