Flex Fuel Vehicles: One Way to Lower Emissions and the Amount spent on Imports

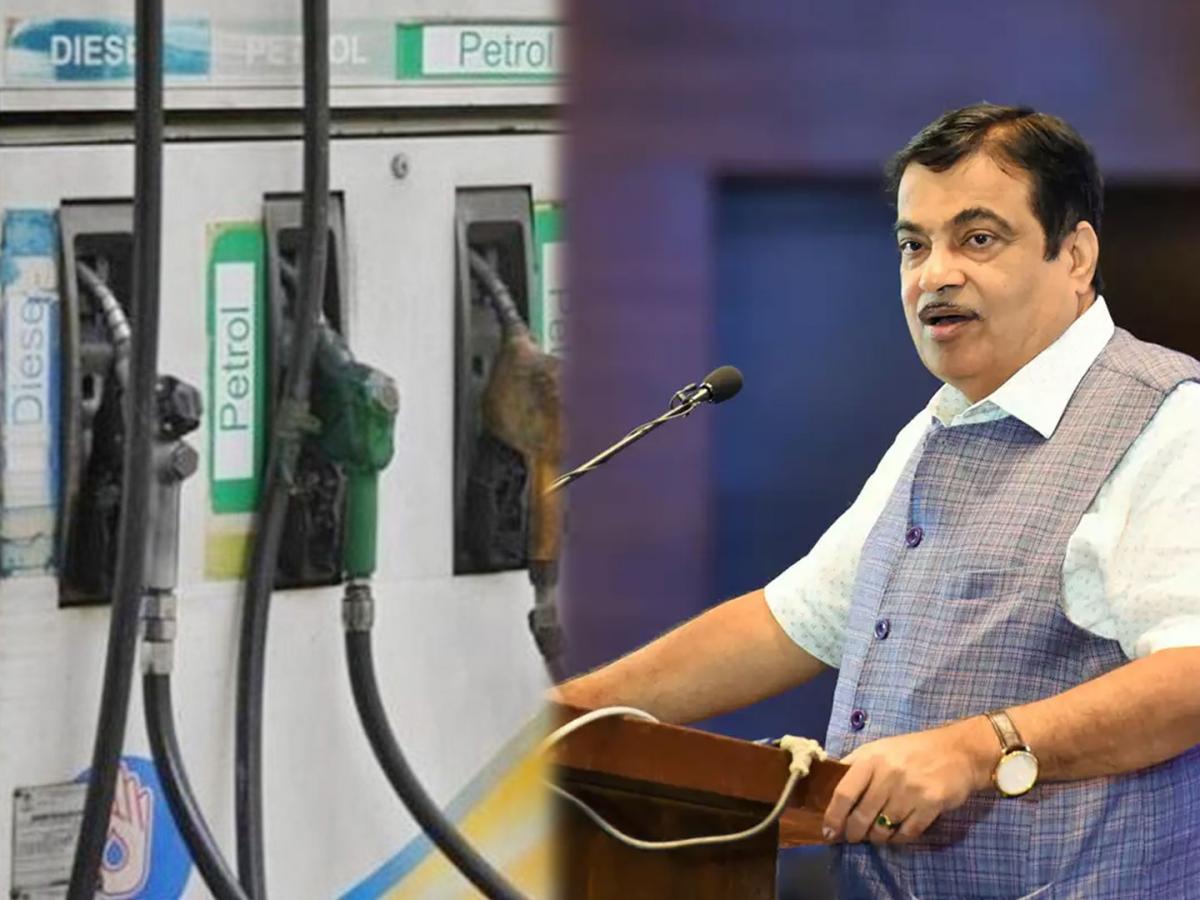

Union Minister for Road Transport and Highways Nitin Gkdirkj has requested the Finance Minister to slash the GST rate on flex-fuel vehicles to 12%. At present, these vehicles are charged GST at 28% being in the same bracket as ICE vehicles. Gadkari pointed out that flex-fuel engines not only favour displaying emissions but also may contribute towards saving up to RS 22 lakh crore annually which India spends on the import of fossils. Speaking at the India Bio-Energy & Tech Expo, Gadkari said that developing economies cannot sit on the sidelines when it comes to flex-fuel engines as they are the future of the automobile industry and the environment.

The government’s commitment to biofuel technology is also evidenced by the manner in which funds have been allocated to this industry The government’s commitment to biofuel technology is also evidenced by how funds have been allocated to this industry.

While speaking Gadkari revealed that he has personally written to both the Union Finance Minister Nirmala Sitharaman and state finance ministers to request for the reduction of GST. He also said that the Maharashtra Finance Minister has been required to suggest this slash in the next GST Council meeting. To quote Gadkari, the biofuel technology could increase the export potential by 10-20 per cent,” Speaking on the economic gains as well as environment improvement, Gadkari said:

Ethanol Blending: In this case, it can be christened as the Success Story.

The other dignitary present during the event was the honourable minister of Petroleum & Natural Gas, Hardeep Singh Puri who also said his bit, acknowledging the growing global awareness of bioenergy, which is a viable, renewable and sustainable source of energy compared to the fossil fuels. Besides, Puri spoke of the success of the Ethanol Blending Programme in India, which is up from 1. In 2014 it was 53% and the target set for 2024 is 15%, with the aim of the EU to reach 20% by 2025. This has brought down the foreign exchange by ₹99,014 crore, and decreased CO2 emissions by 519 lakh tonnes, in addition to replacing 173 lakh tonnes of crude oil.

Consequent Implication on the Economy; Farmers and the Energy-Related Organization

Puri pointed out other economic impact importance of the programme where Oil Marketing Companies released ₹1,45,930 crore to distillers and ₹87,558 crore to farmers. He also expressed his gratitude for the help received from the Pradhan Ji-VAN Yojana in promoting biofuel which is essential for the development of Ethanol projects to make India future-ready.

![]()