In a major sign of revival and financial discipline, Non-Performing Assets (NPAs) in India’s Micro, Small, and Medium Enterprises (MSME) sector have declined by 67% in FY2024–25, according to recent market insights. This remarkable improvement is attributed to a combination of targeted government support schemes, improved credit access, and digitally enabled lending frameworks.

Key Drivers of NPA Reduction:

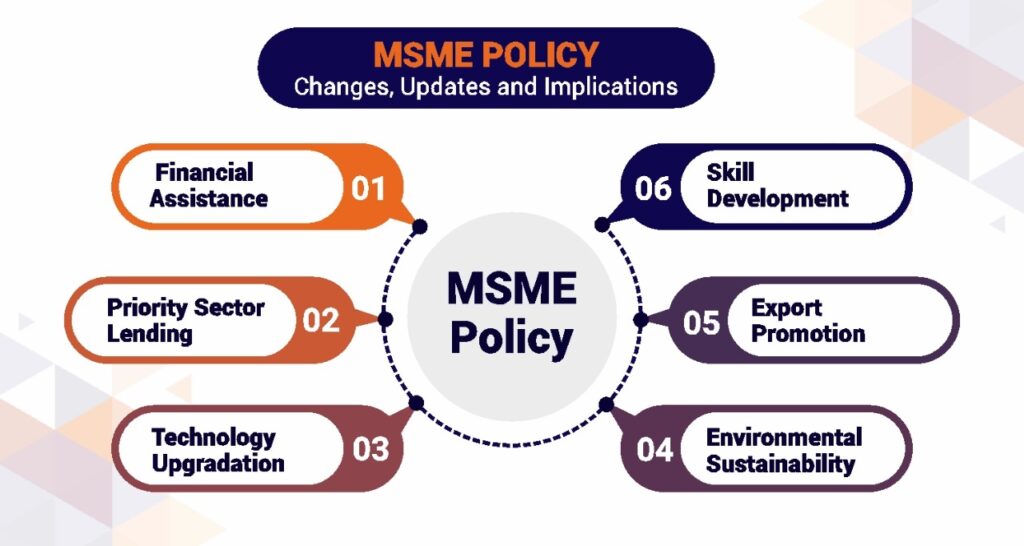

Policy-Backed Credit Schemes:

Government initiatives such as Emergency Credit Line Guarantee Scheme (ECLGS) and Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) have helped MSMEs restructure their liabilities and access working capital during critical phases.

Digital Credit Platforms:

Fintech-led innovations and public platforms like Account Aggregator (AA) and Open Credit Enablement Network (OCEN) have transformed MSME lending. These systems enable lenders to assess real-time financial health, lowering loan defaults.

Better Cash Flow Visibility:

Integration of GST data, digital invoices, and banking records has given lenders a 360-degree view of business performance, reducing risk in lending decisions.

Improved Financial Literacy and Compliance:

MSME owners are becoming more aware of maintaining credit discipline, adopting digital tools, and ensuring timely repayments to retain their creditworthiness.

Sector Outlook:

With reduced NPAs, banks and NBFCs are expected to increase lending to creditworthy MSMEs, further boosting sectoral growth. Sectors such as manufacturing, logistics, and services are leading in credit performance.

India Advocacy’s Support:

At India Advocacy, we help MSMEs maintain compliance, improve credit profiles, and resolve disputes related to NPAs or loan restructuring. Our experts provide legal advisory, credit documentation, and lender negotiation services to keep your business financially healthy.

![]()