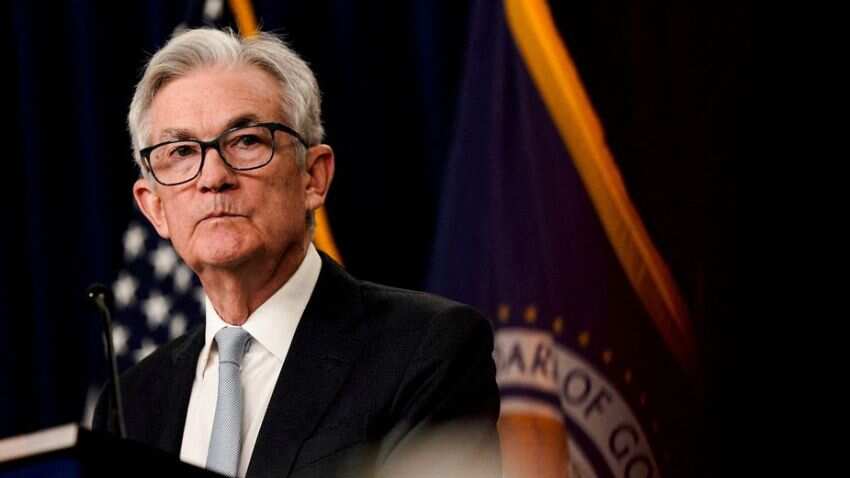

US stock futures experienced a boost, while Treasuries saw a decline following the weekend agreement to avoid a US government shutdown. Investors are now eagerly awaiting comments from Federal Reserve Chief Jerome Powell later today.

During early Asia trade, S&P 500 futures surged by as much as 0.7% after US lawmakers passed a compromise bill on Saturday to keep the government funded until November 17. In Asia, the stock benchmark erased earlier gains, and European equity futures saw a slight drop. Several Asian markets, including China, remained closed for holidays.

Yung-Yu Ma, Chief Investment Officer at BMO Wealth Management, noted, “Financial markets were bracing for a shutdown, so there’s an element of relief, but it’s only a temporary lifting of one of the clouds hanging over the markets now. Interest rates and Fed hawkishness remain the name of the game and the main driver of the markets over the next few weeks.”

Jerome Powell is scheduled to participate in a roundtable discussion in Pennsylvania, along with Philadelphia Fed President Patrick Harker. This week, the spotlight will also be on US manufacturing activity and jobs data after the head of the New York Fed suggested on Friday that policymakers should keep interest rates high for a while.

Following the resolution of the US government shutdown, Treasuries saw a drop, with investors refocusing on the future path of interest rates. US 10-year yields increased by four basis points to reach 4.61%, while their five-year counterparts climbed a similar amount to reach 4.64%. The US dollar strengthened against all Group-of-10 peers.

Vasu Menon, Managing Director of Investment Strategy at Oversea-Chinese Banking Corp., said, “The higher-for-longer rates, tighter fiscal policy going forward, higher bond yields, at least in the short term, will all come to roost and impact the economy and cause a slowdown,” potentially leading to a US recession in the first half of 2024. He made these remarks on Bloomberg Television.

The Bank of Japan announced that it will conduct an additional buying operation for government bonds on Wednesday. This news led to a reduction in losses for ten-year bond futures, while the yen maintained its earlier declines.

Japanese government bonds saw declines, and stocks received a boost after Japan’s quarterly Tankan survey showed that confidence among large manufacturers had improved more than anticipated. A summary of the central bank’s policy meeting last month also indicated that officials were more positive about considering policy revisions.

The gains in US stock futures on the first trading day of October may temporarily alleviate the challenging period faced by global financial markets. Elevated interest rates resulted in the July-to-September quarter being the worst for MSCI’s all-country equity index since September 2022, as surging oil prices added concerns about inflation and slowing economic growth.

In other news, oil prices increased amid speculation that global demand is outpacing supply.

![]()